Eritrea: USA focus on extraction operations abroad

Will new US focus on extraction operations abroad lead to changes here?

Will new US focus on extraction operations abroad lead to changes here?

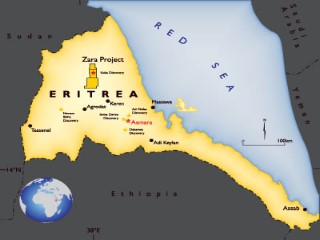

Last month, the US Commission on International Religious Freedom, a division of the State Department, recommended that the US deter foreign mining in Eritrea following allegations of religious oppression taking place in the small African nation. "The U.S. government should...prohibit any foreign company's raising capital or listing its securities in the United States while engaged in developing Eritrea's mineral resources," the report read. In recent years, Canada has also expressed concerns about the human rights situation in Eritrea, "particularly with regard to the respect for democracy and the rule of law, the imprisonment or ill-treatment of political opposition and journalists, and the protection of civil liberties," reads the Foreign Affairs website.

Despite this, Canada hasn't put any restrictions—let alone talked about restrictions—on Canadian mining operations in the African country, a point that is relevant given that Vancouver-based Nevsun Resources has major operations there and is expected to start producing gold at a major mine later this year. Canada is home to 60 per cent of the world's mining companies. And it's an industry that's growing, particularly in developing countries. Canadian investments in the mining sector abroad have skyrocketed from $30 billion in 2002 to $110 billion in 2008, with $57 billion in Latin America and $20 billion in Africa. But over the past few years, Canadian mining companies operating in developing countries like Eritrea have been put increasingly on the defensive.

While most have publicly embraced the idea they must operate responsibly and help, rather than hurt, the communities in which they are working, there has been a concerted effort to fight off mandatory requirements, increased involvement by the federal government and other measures. Witness the battle surrounding Bill C-300. Now it appears a second front in the war could be opening up. On Nov. 19, Democratic Congressman Jim McDermott introduced the Conflict Minerals Trade Act in the House of Representatives. The motivation behind this bill was "to improve transparency and reduce the trade in conflict minerals coming from the Democratic Republic of Congo (DRC) in order to promote the larger policy goal of supporting peace and security in the DRC."

If enacted into law, the act would specifically ensure that the minerals used by US companies in their products do not directly finance conflict, result in labour or human rights abuses, or damage the environment—all major CSR issues. Luke Popovich, vice-president of the American Mining Association, the US industry's lead lobby group, believes that the victories for the Democratic Party in the presidential and congressional elections in 2008 were a pivotal point. That resulted in CSR being pursued in a more aggressive fashion, he said, both legislatively and administratively. However, six months earlier, in April 2009, Republican Senator Samuel Brownback introduced a similar bill, titled the Congo Conflict Minerals Act.

Mr. Popovich believes the media has been a major catalyst for bringing about public, and therefore congressional, attention to mining practices conducted by US companies, though he thinks much of the reporting has been unfair. "Why is there a spike in interest? Maybe it's because of media-generated and NGO-generated exposés of alleged abuse and exploitation of Third World-resources by mining companies," he said. "Some of these might be valid. But I think there has been a broad brush approach towards stigmatizing mining."

Despite this, the AMA has taken a more conciliatory and accommodating stance than its counterparts in Canada. "There is an extractive industries transparency initiative, which is an amendment that we don't oppose," he said. "It's in the current Senate bill and would require a range of companies, not just mining companies, to report annually to the [Securities and Exchange Commission]," he said. In addition, he said the AMA is not opposed to another Senate bill that would require companies to disclose to Congress all payments companies make to foreign governments for the purpose of commercial development of oil, natural gas, and minerals.

Mr. Popovich was careful to note that while the AMA hasn't professed active support for these bills, American mining companies that are active internationally have to comply with "similar laws in other countries in any event," and are under pressure from various quarters domestically. Therefore, he said, it is impractical to oppose such measures. "Our companies face much pressure by NGOs to comply with a more stringent groups of rules that would guarantee that they are not paying into armed trust funds for thugs, and exploiting minerals, and are not paying for corrupt practices."

Questionable impact on Canada

In Canada, legislative measures such Bill C-300 are, in contrast, being held up and subjected to considerable attacks from the mining industry and its political supporters. The bill would in essence hold extraction and mining resources operating aboard accountable through federal oversight and penalize violators by denying them public funding. Some commentators hope the scrutiny being placed on the industry in the US will affect things in Canada. "There is a lot of legislative action happening in the US that, at a minimum, requires a response from Canada because the TSX has the highest concentration of investment in mining in the entire world," said NDP Foreign Affairs critic Paul Dewar. "So I think at some point there will be an echo [from the United States] and there be questions about what Canada is doing, and not just from legislators like myself."

Mr. Dewar is drafting his own bill, which will be introduced the fall which he hopes will force more accountability from the Canadian mining industry. When Nevsun Resources was asked to respond to the US report, president and CEO Cliff Davis wrote in an email: "We see the mining industry as a very positive addition to the country's economy, particularly given the responsible approach taken by the government in the overall cautious development within Eritrea. "With additional wealth generation to the people of Eritrea we would expect the country to improve over the next few years as the multiplier impact on employment and supply chain takes effect. It would be good if the [US Commission on International Religious Freedom] understood the very positive impact of responsible economic development."

Canadian industry officials say what happens in the US won't necessarily have an impact in Canada. In particular, they note that the bills introduced by the two congressmen haven't come into law, and that the US Commission on International Religious Freedom was simply making non-binding recommendations. "It may be an overstatement in saying that...the Conflict Minerals Trade Act or the finding of the US Commission on International Religious Freedom represent official US government policy or a change to existing US foreign policy," said Maggie Papoulias, a spokesperson for Mining Association of Canada.

Trade Minister Peter Van Loan, meanwhile, stood by the government's efforts to essentially help Canadian mining act in a more socially responsible manner. "Through its leadership, clear rules, advanced guidelines and leading edge technologies, Canada continues to foster and promote sustainable development and responsible business practices in countries where Canadian mining companies operate," he said in an email. John McKay, the Liberal MP who sponsored Bill C-300, wasn't optimistic that the activity in Washington would lead to the government reconsidering what critics have described as a weak effort to hold Canadian mining companies to account. "I think its reasonable to speculate that it has a lot to do with the influence on the mining companies on their government," he said. "And I also think its an ideological pre-disposition to be hands off, regardless of how egregious the actions of the corporation may be abroad."

Contact the author at:

This email address is being protected from spambots. You need JavaScript enabled to view it.

![[AIM] Asmarino Independent Media](/images/logo/ailogo.png)